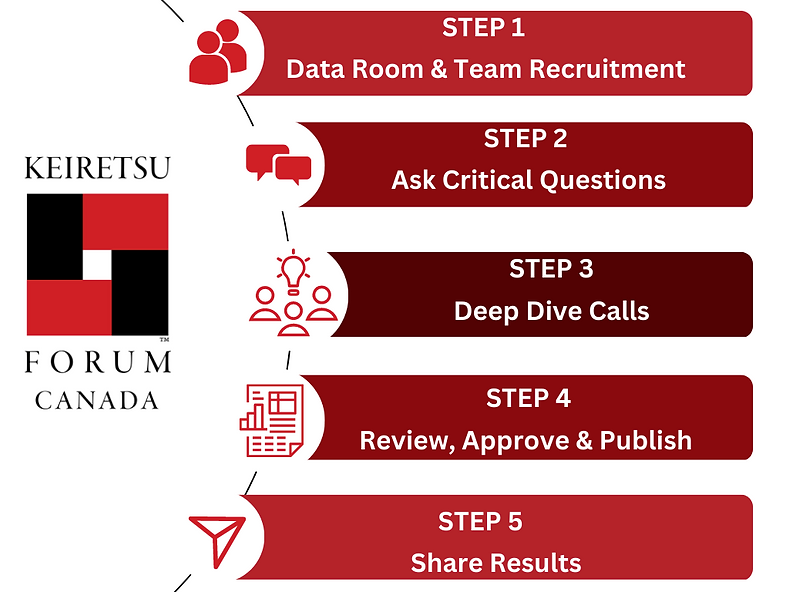

DUE DILIGENCE

Due diligence is an essential part of the angel investing process. It is the process of assessing the potential risks and rewards of a certain venture before making an investment. Through an in-depth analysis of a company, its operations, and its financials, angel investors can make informed decisions about where to allocate their capital. Our due diligence services provide investors with the information they need to make sound investments.

Step 1: Data Room & Team Recruitment

Before beginning the due diligence process, it is essential to populate the data room with all the pertinent information about the company and attach the specific documents requested by the Keiretsu Forum team. Without complete data, due diligence cannot commence. Additionally, it is the entrepreneur's responsibility to take charge of the due diligence team recruitment process. It would be best to invite angel investors who are enthusiastic about the company and are likely to invest.

However, selecting the right investor to join the team is up to the entrepreneur. To pick the right investor, it is essential to converse with them and understand their investment abilities and willingness. If you believe that an investor is the right fit but is currently not investing any capital into companies, it is recommended to search for someone else instead of persuading them. It is optimal to have no more than 5-6 investors on the due diligence team. Furthermore, investors with experience in various fields such as finance, technology, etc., should be invited to utilize their expertise in the due diligence process.

Step 2: Ask Critical Questions

During this phase of the due diligence process, the Keiretsu Forum team will oversee the launch, examination, arrangement of deep-dive calls, and preparation of questionnaires. The team will also be available to assist in resolving any concerns that may arise.

Step 3: Deep Dive Calls

During this stage of the process, the due diligence team and the entrepreneur will maintain regular communication via in-depth sessions. These sessions can last an hour or more and center around the information the due diligence team requires from the company. The Keiretsu Forum team will be present to transcribe each deep-dive call. Following each session, the Keiretsu Forum team will gather, refine, and edit the transcriptions and add them to the "DD Notes" document in a question-and-answer format. This document represents the initial version of the DD report and is shared with the due diligence team to review and validate the accuracy of all the data. Typically, it takes four to seven deep dives to collect all the essential data from the company.

Step 4: Review, Approve & Publish

As this point of the Due Diligence process, the Keiretsu team will create a document called a "Zero/Rough Draft." This document is a comprehensive summary of all the data received thus far from the deep dives. The document is divided into sections and formatted in a user-friendly manner. The due diligence team and entrepreneur are responsible for reviewing the data contained within and verifying its accuracy. Any missing data may be added at this stage. We highly recommend using the "Track Changes" feature in the document to keep track of any modifications made and their origin. Once all changes have been implemented, and the document has been polished, it will proceed to a final stage known as the "Final Draft" format.

Step 5: Share Results

During the final stage of the process, the Keiretsu Forum team incorporates logos, executive summaries, Term Sheets, investor references, investment reasons, potential challenges, background checks, and other relevant information into the final draft. The team will refine the language to give it the appearance of being composed by a neutral third party and introduce a template to align with the appearance of our professional DD reports.